Santander gives first-time buyer mortgage to 70-year-old as average age goes up: "Proof that the UK property market is broken"

NEW data from Santander shows the oldest first-time buyer (FTB) it supported in 2025 was 70-years-old – and one in five are over 40 – with experts warning it shows “the UK property market is broken”.

Older first-time buyers are taking an ever-growing share of the market, with one in five (22%) FTBs in 2025 aged over 40, up from 18% in 2024, Santander said.

While the average age of FTBs has been creeping closer to 40 over the past few years, data from the lender also shows a sharp rise in those over 60 buying their first property, up 14% compared to 2024.

The oldest FTB it helped in 2025 was 70 years old, compared to 67 in 2024.

The proportion of buyers aged 25 and under has fallen sharply in the last year, down by almost a quarter (23%) from 2024 to 2025.

Despite this, the youngest FTB this year was 18, highlighting that entry into home ownership doesn’t necessarily equate to age.

David Morris, Head of Homes at Santander, said: “Our recent data shows that it is never too late to realise your homeownership dream. This year has very much been the year of the buyer, with regulatory changes giving buyers renewed confidence that owning a home is within reach.

"Whether buying with family gifts, relying on inherited wealth or simply saving across decades to secure a deposit, we’re pleased to have helped so many first-time buyers across the generations.

“But there is still more that can be done, and our data also highlights a growing disparity for first-time home ownership, with the gap widening between younger and older generations as the market grapples with the impact of stamp duty changes and a lack of supply.”

Andrew Montlake, CEO at London-based Coreco, said the figures reveal just how broken the property market is.

He added: "That more than one in five first-time buyers is now aged 40 plus is all the proof you need that the UK property market is broken. The answer to fix it is simple enough: we need to build more homes.

"A lack of homes being built is driving prices up and keeping many off the ladder for years, if not decades. Saving up for that all-important deposit is not being made easier by inflation remaining well over target and rents wiping out any potential for savings.

"This grim data shows that we urgently need a long-term plan, and one that is backed by a cross-party committee led by an industry-experienced housing tsar who will finally get things moving in the right direction."

Omer Mehmet, Managing Director at Welling-based Trinity Finance, said it was increasingly difficult to get on the property ladder.

He continued: “This data highlights the Everest that first-time buyers have to climb. That people have to wait so long to get the first set of keys to their new home should send a shot across the bows to this government and future ones. We need to start building homes, fast and at scale.”

Katy Eatenton, Mortgage & Protection Specialist at St Albans-based Lifetime Wealth Management, said it revealed a “Broken Britain”.

She added: “This data shows the key structural issue impacting the UK's property market. In short, that we are not building anywhere near enough homes. As a result, prices continue to rise inexorably, smashing the dreams of would-be homebuyers. Until we build more homes, we will remain in Broken Britain.”

Riz Malik, Director at Southend-on-Sea-based R3 Wealth, said he has seen FTBs get older.

He continued: “Over the past 20 years, I have seen first-time buyers get older and older, and most of them are doing so via parental assistance. Even as borrowing capacity improves, house prices remain high relative to average incomes. The only solution is to build more houses, but we seem incapable of doing that at scale.”

Emma Jones, Managing Director at Runcorn-based Whenthebanksaysno.co.uk, predicts that the average age of a FTB will continue to go up.

She said: "This data is a damning indictment of successive governments, none of which have managed to achieve the one thing that would solve the first-time buyer crisis: building more homes.

"Until we fix that, the figures will simply get worse, despite the fact that lenders are doing their best to find new ways to get people onto the ladder. For many, the dream of homeownership will remain precisely that."

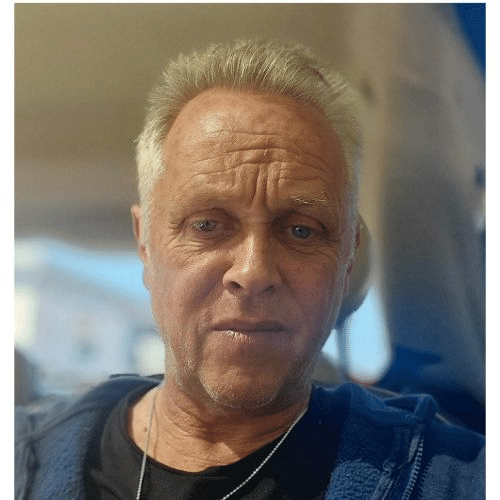

Jonathan Moser, CEO at London-based Mo'Living, said he still rents at the age of 60.

He added: “I have a property management company which manages over £40m worth of residential properties in London, yet (at the age of 60) I still rent. I intend to buy my first home when I'm 65. The end.”

Patricia Ogunfeibo, Founder at tenant2owner, said many are told they just cannot afford to buy.

She continued: "Too many renters are told they can never buy – for one reason or another, not all of which are true. It is commendable that Santander has given this 70 year old a mortgage – a fact that debunks the myth ‘you’ll never get a mortgage once you celebrate your 60th birthday’.

“It must have been a dream come true for the 70 year old. How many others are being robbed of their homeownership dreams?”