Borrowers urged to “act sooner rather than later” as Santander increases mortgage rates

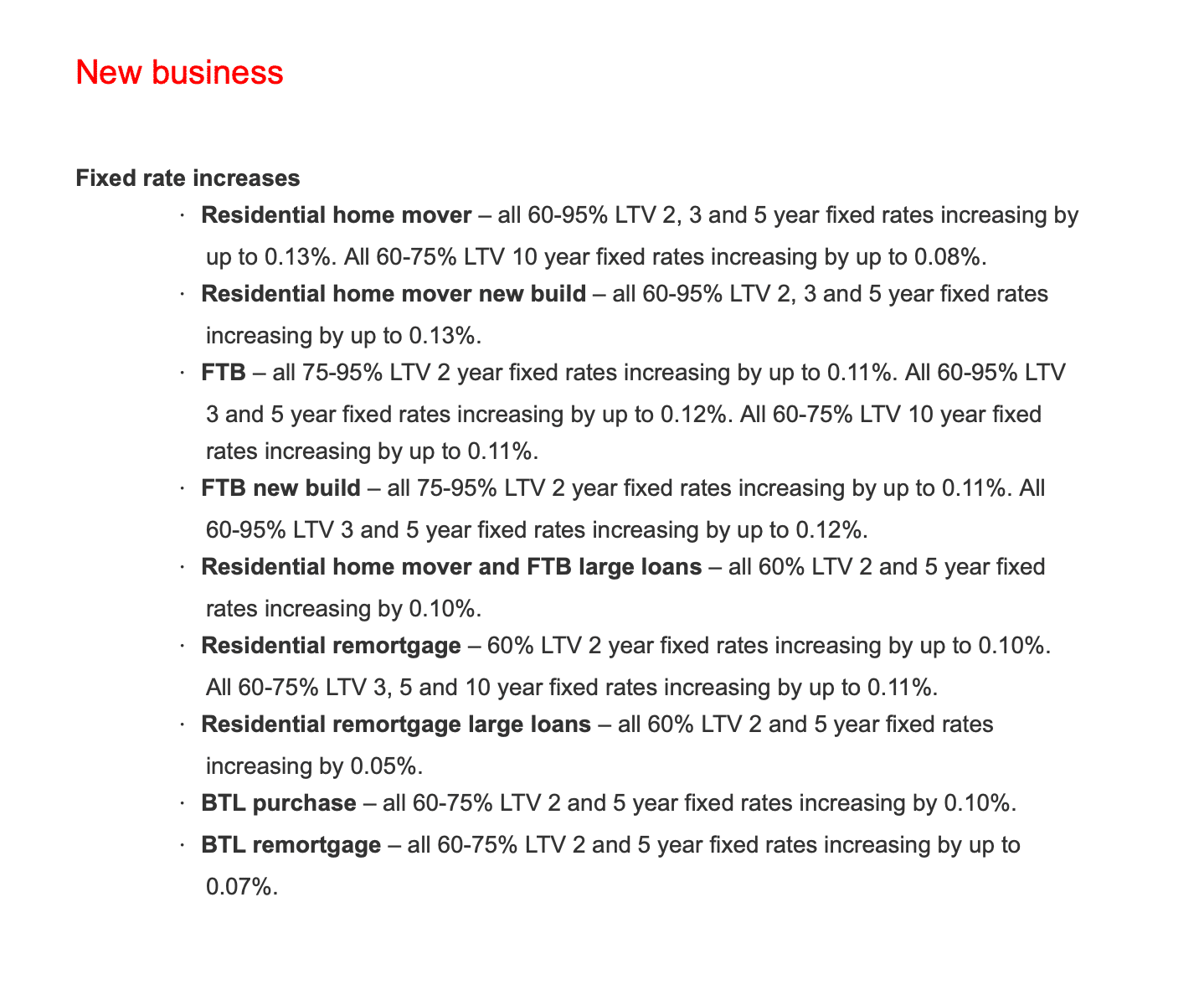

BROKERS have urged borrowers to “act sooner rather than later” as Santander is the latest major lender to announce residential and buy-to-let fixed rate increases today of up to 0.13%.

Ranald Mitchell, Director at Norwich-based Charwin Mortgages, said Santander’s decision to nudge up fixed rates is a reminder that the mortgage market remains finely balanced.

He added: "While this is bad news for borrowers hoping to see further cuts, rates are still sitting in a relatively good place compared with recent years. With no guarantees on where the market will head next, those in need of a mortgage should act sooner rather than later as delaying could mean paying more.

“The clear message is that the best deals are often short-lived, and borrowers who wait for certainty risk missing out.”

Jack Tutton, Director at Fareham-based SJ Mortgages, added: "The gloom for mortgage holders continues as Santander follows many other lenders in increasing their rates. We have seen widespread increases across the mortgage market in the past week and there are no signs that this is going to change anytime soon.

“Instability in government is causing chaos in the finance markets, which is why we are seeing mortgage rates increase. Given that the Budget is approaching, there are no signs that things will get better for mortgage holders in the short term at least.”

Babek Ismayil, Founder at homebuying platform OneDome, said: “What started as a trickle is now turning into a stream of mortgage rate increases. Though not huge increases, rates, for now at least, are moving in one general direction and that's up. Borrowers need to get in touch with a good broker to lock in rates before they disappear.”

David Stirling, Independent Financial Adviser at Belfast-based Mint Wealth Ltd, said: “Santander are the latest big player to hike their fixed rate deals in a response to increasing swap rates and general economic woes including inflation and the ever-diminishing chances of a Bank of England rate cut.”

Emma Jones, Managing Director at Runcorn-based Whenthebanksaysno.co.uk, said the domino effect among UK lenders continues: "Each day now we're seeing major lenders increase their mortgage rates. More rate rises are almost certain during September, which is not the news borrowers will want."

Meanwhile, Elliott Culley, Director at Hayling Island-based Switch Mortgage Finance, said these latest hikes will cast a shadow over the market: “The majority of lenders have increased rates over the past two weeks as swap rates have increased. The increases on the whole have not been large increases, and mortgage lenders have remained resilient and not pulled the lever on borrowers as quickly as they have in the past. However any rate increases adds doom and gloom to the mortgage market, which is still in recovery mode.”