Santander increases fixed rates

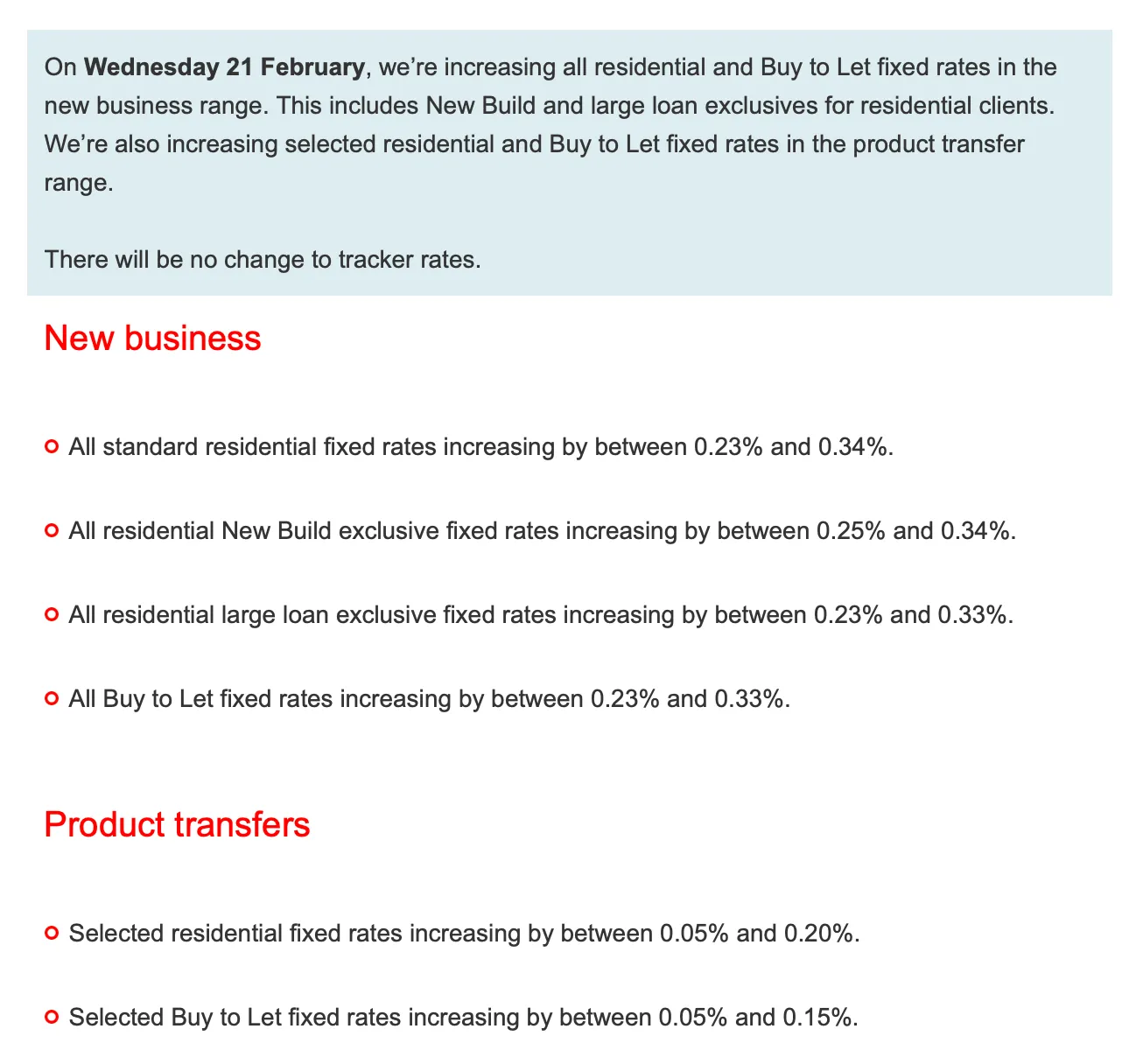

Santander has just announced it is increasing all residential and Buy to Let fixed rates in the new business range from tomorrow, Wednesday 21 February — by up to 0.34%. This includes New Build and large loan exclusives for residential clients. It is also increasing selected residential and Buy to Let fixed rates in the product transfer range. There will be no change to tracker rates. Changes in screengrab, below. Newspage asked brokers for their views, bottom. .

.