Santander cuts rates in "yo-yo" mortgage market

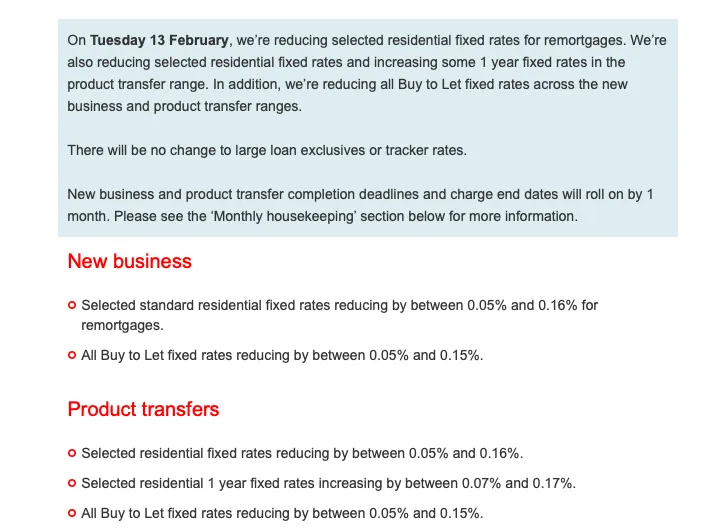

Santander has just announced a series of rate cuts for those looking to remortgage or take out a Product Transfer, including residential and buy-to-let deals. Newspage asked brokers for their thoughts on this interesting re-price from Santander, and what effect this might have on the rest of the market in the coming days. Their views can be seen below.